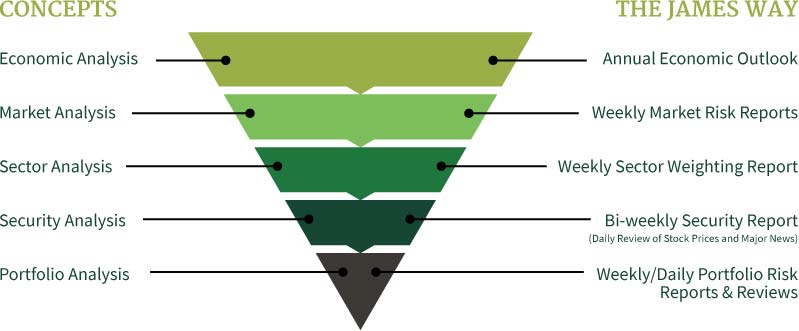

Our Process

The James philosophy is to grow clients’ funds while stressing the preservation of capital. The goal is to minimize downside risk without limiting upside potential. Our proprietary ranking system, alongside continuing research, helps us to achieve desired results in client portfolios.

"By re-evaluating everything we do on an ongoing basis, we continually keep ourselves fresh, and that’s one of the reasons we’ve been able to stick around for 40 plus years."

Overview

Weekly Market Risk Reports

- Report Prepared Each Weekend For Over 40 Years

- Developed Over 100 Proprietary Stock And Bond Market Risk Indicators

- Strive To Look Beyond The “Wisdom Of Wall Street”

- Revalidate All Indicators Every Other Year

Risk Filtration

The James Proprietary Ranking System

- Time Tested System Looking at 415 Data Items Since 1986

- Ranks Stocks On Relative Attractiveness

- Scale From 1 to 100, 1 Equals The Best Expected Bargain

- Review Results Monthly

Continuing Research

- Revalidate Ranking System Every Two Years

- Review Monthly Model Performance

- Compare Growth Versus Value

- Sector Performance

- Review Market Capitalizations

Research

At its broadest terms the research performed by James Investment has two primary purposes, to identify the risk levels of the stock and bond markets and to choose what we feel are the best available securities.

Each year a major effort is placed on discerning the long-term path of the economy, stocks, bonds, and international markets. This provides guidance in determining whether markets are giving us opportunities to buy or sell or whether a recent movement in the market is simply fool’s gold.

The risk levels of the market are assessed every weekend with the help of James validated market risk indicators. Presently, we have over 100 separate market risk indicators. Each indicator is classified as favorable, neutral, or unfavorable. While no single indicator is deemed to be perfect, it is normal for the summation of the indicators to provide guidance for the future.

Likewise, James Investment is also concerned about individual stock selection. We continue to develop, research, and test our stock selection model. This quantitative model is used to provide guidance on an individual stock’s potential. We have found that this ranking system recognizes attractive buy candidates. Perhaps its best value is found in our sell discipline. If a stock ranks poorly in our ranking system, the security will be reviewed by the investment committee for possible sale.

Quantitative Inputs

Valuation

1. Fundamentals

2. Neglect

- # of Analysts by Market Cap

- Analysts' Long Term Projections (Contrary)

- Institutional Ownership

3. Management

- Change in Shares Outstanding

- Insider Trades

- Management Holdings

Earnings

- Return on Assets

- Earnings Momentum

- Quarterly Surprise

Strength

- Relative Price Performance

- Larger Time Period

- Compared With All Stocks

Equity Buy Guidelines

Appropriate Size

- Small/Mid/Large

- Typically $250M And Above

Sector Selection

- Top Down Economic Analysis

- Bottom Up Model Sector Ranks

- Optimized Historical Sector Weights

Individual Stock Analysis

- Income Statement

- Balance Sheet

- Fundamentals

- Earnings

- Price Chart

- Major Developments

- Insider Ownership

- Shares Available

- Trading Volume

- Strong Ranking/Strength Based On JIR Analysis

Investment Committee Approval

- Presentation

- Voting

- Most Junior Member Votes First

- Majority Vote

Portfolio Team Purchase

- Liquidity Review When Purchasing Small Cap

- Monitor Chart Pattern

Trader

- Humans Add Value To Process

Equity Sell Guidelines

Decline in Rank

Sector Diversification

- Diverge From James' Tolerances

Significant Market News/Activity

Individual Stock Analysis

- Income Statement

- Balance Sheet

- Fundamentals

- Earnings

- Price Chart

- Major Developments

- Insider Ownership

- Shares Available

- Trading Volume

Investment Committee Approval

- Presentation

- Voting

- Most Junior Member Votes First

Sell

- Work Trade With Current Price Action And Size Of Position

Trim

- Consider Trimming If Position Grows To Over 8% Of Portfolio